How Krystal Pino Founded Nomad Tax: Accounting for Digital Nomads

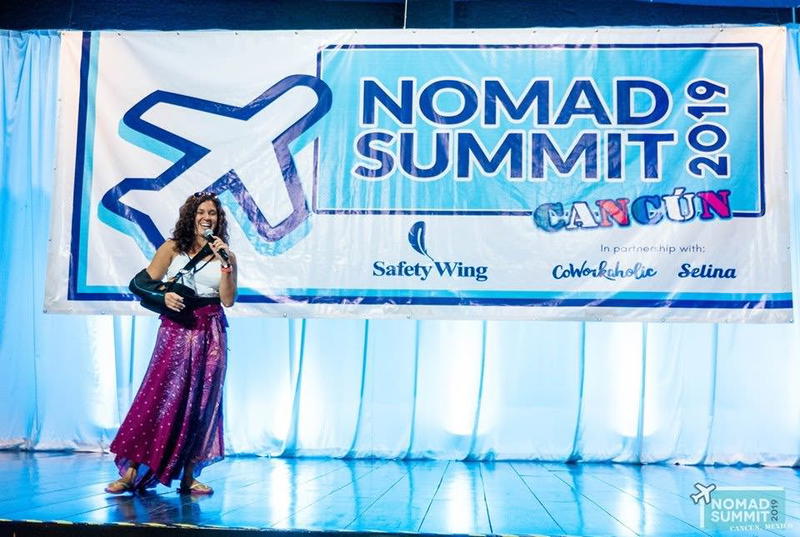

Krystal Pino started Nomad Tax when she saw that tax services and accounting for digital nomads didn’t exist yet, after working remotely and traveling abroad. See the interview.

This article may contain affiliate links. We earn a small commissions when you purchase via those links — and it's free for you. It's only us (Becca & Dan) working on this website, so we value your support! Read our privacy policy and learn more about us.

Table of contents

- When did your personal travel journey begin? Were there any significant experiences?

- When was your first digital nomad journey, and how did you find yourself traveling that way?

- Tell us how Nomad Tax began and how it originally started to serve digital nomads.

- Through the years, how has the business grown in its offerings, services and team?

- How is Nomad Tax continuing to change and adapt as the world of remote work evolves?

- What are some of the coolest learnings you’ve had, about how travel affects taxes?

- Do you have any advice for aspiring digital nomads? What should they know about taxes?

- Follow Krystal & Nomad Tax online

Probably one of the interviews in our travel professional series that I am most excited about is this one, with Krystal Pino, the founder of Nomad Tax.

Nomad Tax is the answer for any digital nomad who has ever gone remote to travel and thinks, “I’m a digital nomad—what do I do about my taxes?!”

Krystal is a remote worker, and avid traveler herself, so the story of how Nomad Tax began is an exciting one. Krystal and her team of employees, consult and do accounting for digital nomads, freelancers and other location-independent business owners whose taxes are more unique than the regular work-from-home W2 professional.

I enjoyed reading Krystal’s answers to my interview questions, and I hope you do, too. At the end, find how to follow Krystal on socials, as well as how to start the conversation of having Nomad Tax take handle your digital nomad accounting and taxes this year.

When did your personal travel journey begin? Were there any significant experiences?

My personal travel journey started a little later in life.

Despite doing a summer abroad program to France when I was 15, I lived in the US until I was 34. I was fresh out of a long-term relationship and looking for a change when the opportunity to travel and work remotely fell into my lap.

When was your first digital nomad journey, and how did you find yourself traveling that way?

My first digital nomad journey and my first travel experience was Remote Year back in 2017.

As I mentioned before, I had just gotten out of a relationship that lasted nearly a decade, and I learned about Remote Year from a friend.

I was out of my relationship, but also in a career that I loved, and that was really starting to take off. Back in 2017, remote work was still new, and my conservative accounting firm said ‘absolutely not’ when I asked my company to work remotely and travel, so I had to make what was, at the time, a tough decision.

Encouraged by friends and family, I decided to leave my job and take the once-in-a-lifetime opportunity to see the world.

Tell us how Nomad Tax began and how it originally started to serve digital nomads.

After my year with Remote Year was over, I kept traveling the world.

I had found a remote accounting job during RY, but I was also offering my tax expertise to the community on the side, as well.

About 18 months into my digital nomad journey, I started to really notice that there was a gap in the tax offerings to digital nomads. I was becoming increasingly frustrated at my current job, where I was siloed, and often scapegoated, specifically for being “international.”

One day in Sofia, Bulgaria, apparently tired of hearing me complain about my job, my good friend, travel mate and (then) roommate said, “Well, why don’t you stop giving your tax advice away for free?”

It got my wheels turning, and within six months, I had quit my job and started Nomad Tax.

Through the years, how has the business grown in its offerings, services and team?

I started Nomad Tax in December of 2018 with myself and one other tax preparer.

It was already a good time to be in business serving digital nomads, as remote work was growing, but the pandemic catapulted us to another level.

With companies suddenly forced to adopt remote work, “work from anywhere” became hugely popular, even in a world that was shut down, for the most part. The growth of location-independent working and geographic arbitrage led to the growth of our client base, from 125 clients in 2019 to over 500 clients, and from a team of 2 to a team of 12 (location-independent, of course).

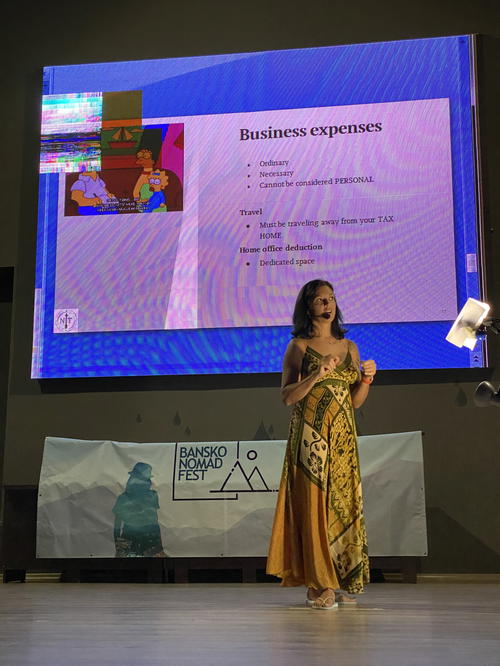

For the most part, I’ve kept to the core offering of Nomad Tax (individual and small business consulting and preparation for location-independent workers). It’s a unique niche that keeps us on our toes every day, and tax laws are always changing.

Over the past two years though, we have grown the bookkeeping side of the business, so we can offer a more rounded set of services for our small business clients.

How is Nomad Tax continuing to change and adapt as the world of remote work evolves?

Nomad Tax is incredibly fortunate in that I built this business as a remote worker, for remote workers.

Our main challenge has been keeping up with all the digital nomads that come our way.

I’m admittedly a bit of a bleeding heart when it comes to helping my community. We have had to expand our knowledge base a bit to encompass new strategies that have emerged around location-independent businesses, and we’re always keeping up with the latest tax-planning opportunities for the unique situations our clients find themselves in.

What are some of the coolest learnings you’ve had, about how travel affects taxes?

Certainly the coolest knowledge I have about how travel affects taxes is the piece of information I brought with me when I started my travel journey: the foreign earned income exclusion (FEIE).

For those reading that don’t know, the exclusion allows you to exempt a certain amount of income from federal income taxes if you meet a set of criteria.

Along the way, however, I have enjoyed learning how to employ this exclusion, as well as others, to make sure our clients are optimized in whatever their digital endeavors are.

Lately, there’s been a lot of chatter around offshoring small businesses, so that’s been a great tool to minimize taxes for our clients.

But the funniest thing that I have learned? In the eyes of the IRS, Antarctica is a “continent,” not a country: therefore, time spent there does not qualify for the FEIE!

Do you have any advice for aspiring digital nomads? What should they know about taxes?

When it comes to taxes and the digital nomad, the biggest advantage is the FEIE.

If you can qualify, the tax savings alone could fund a year of traveling around the world. With taxes, it’s always important to play in bounds though, so understanding how your situation fits the statutes that are out there is important.

My number one answer to the majority of tax questions is: “It depends.”

Do your research, talk to tax professionals and make sure you’re getting the most out of your digital nomad journey.

Follow Krystal & Nomad Tax online

You may also like

-

![]()

My Guest Interview on the Holistic Wealth Podcast with Keisha Blair

I was a guest on the Holistic Wealth Podcast with Keisha Blair, talking about leaving a toxic job for long-term travel, my personal finance personality type and more.

-

![A group of people posing for a photo.]()

Daniel Herszberg: Country-Counter with a Travel Mission

Our friend Daniel is a professional country-counter, aiming to be the youngest Australian to travel to every country on Earth. He’s telling all in this interview!

-

![A man standing on top of a mountain in the philippines.]()

@germanbackpacker: Building a Bilingual Travel Blog

Patrick from @germanbackpacker is one of our favorite bilingual travel bloggers who has built a dual-language blog and travel website. Check out his thoughts on building content in English or your native language.

-

![Two people standing on a road with mountains in the background.]()

Carlie & Pat: Off-the-Beaten Path Van Life Travel

What's it like to take a big trip as a couple in a campervan? Carlie and Pat of @verynicetravels told us how to do a 'van life' trip across Europe, and how to deal with unexpected turns during travel.

-

![A person taking a picture with their phone in a busy street.]()

How to Grow Your Audience Using Instagram in 2025

Find out how to connect with your audience, build a brand and create positivity on Instagram. Use some of these tips for making connections and providing helpful content.

-

![A display of colorful paper lanterns hanging from a window.]()

The Neon Tea Party: Crafting with Global Inspiration

Marisa started her crafting business and creative brand from a love of world travel and global inspirations, from Mexico to India. She turned her love for colors and patterns to teaching crafting classes!