What Is Travel Insurance?

Travel insurance is the best way to protect your trip, whether you’re traveling abroad for a short amount of time or for a long-term adventure. Travel insurance is different from primary care insurance because it covers things that could happen to you once you leave home, from stolen belongings to medical bills in foreign countries.

Table of contents

- Do I need travel insurance?

- What does travel insurance usually cover?

- What is not covered in travel insurance?

- Is travel insurance a one-time fee?

- What is the purpose of travel insurance, and why is it important?

- What should I know about filing a claim with travel insurance?

- Does travel insurance cover theft?

- Will travel insurance cover my stolen phone?

- Does travel insurance cover canceled flights?

- Where can I learn more about travel insurance?

This article may contain affiliate links. We earn a small commissions when you purchase via those links — and it's free for you. It's only us (Becca & Dan) working on this website, so we value your support! Read our privacy policy and learn more about us.

Do I need travel insurance?

In almost all cases, you won’t be “required” to have any type of travel insurance during your travel. In fact, it’s sometimes not even worth the hassle of trying to file a foreign $15 insurance claim for a quick visit to a doctor of pharmacy when you are abroad.

When I was traveling in Lima, Peru, I needed to get a doctor’s note to run a half marathon in Argentina.

The doctor visit was simple and cost less than $20. It was covered under my travel insurance; however, the paperwork and process were verbose, and took a long time to complete!

When are the cases when travel insurance is worth it? What exactly does travel insurance cover, and why is it good?

Well, these are all valid reasons why you actually may need travel insurance.

There is really no one-size-fits-all solution because every person and every trip circumstance is different. Every traveler also has a different risk tolerance.

Our travel insurance experience and advice is targeted to US audiences. Some of this information may apply to travelers of other nationalities. Please note we are not certified authorities on travel insurance and all suggestions are merely our own thoughts.

What does travel insurance usually cover?

Your coverage for travel insurance is going to depend on your plan. Generally, the more expensive the plan, the more features and coverage you will get. Or, the more you pay, the more coverage you’ll get. Let’s first look at a high-level list of everything that travel insurance can cover.

- Trip protection: Protects you from cancellations.

- Emergency Medical Insurance: Covers you from visits to the doctor, hospital and dentist.

- Emergency Evacuation: Emergency transportation to a hospital or your home country.

- Gear protection: Covers most theft or damage to your personal (expensive) items.

- Trip interruption

- Trip delays

- Baggage delays or lost luggage

- Rental car damage

- Global assistance

- Accidental death (isn’t death always accidental?)

- Personal liability

- Natural disasters

As you can see, the list is rather long! The list should give you an idea of if the coverage meets your expectations. Certain plan amounts will determine how much within each category is covered.

In a hypothetical example, Plan A costs $50. Plan B costs $100. Let’s work with the example of your laptop being stolen during a trip. You want your travel insurance to pay for your loss.

In Plan A, you may only receive $1,000, whereas in Plan B, you are paid for the estimated value of your laptop.

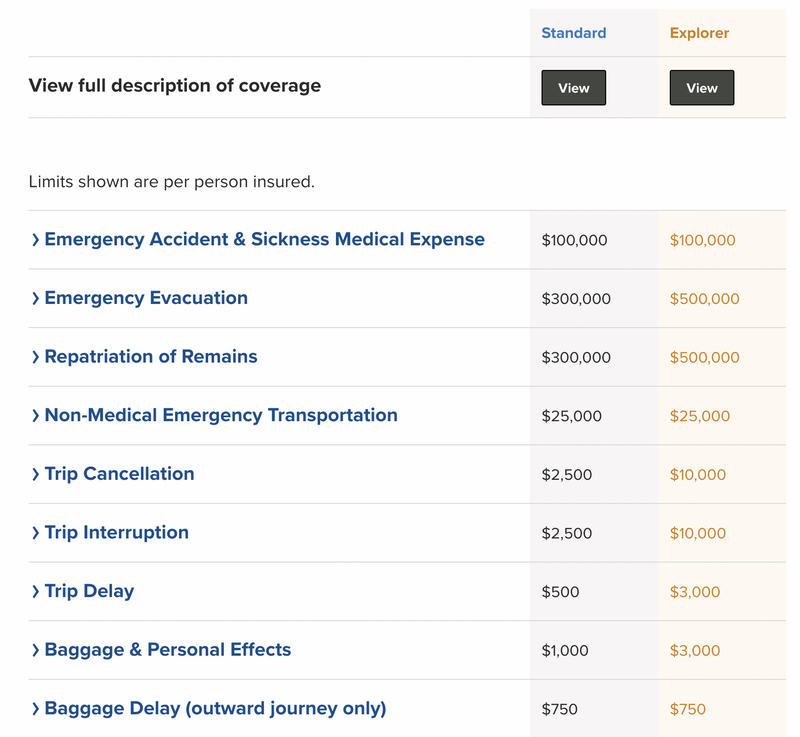

You can see a more detailed version of this scenario from an example policy from World Nomads.

What is not covered in travel insurance?

With a purchase of travel insurance, you probably won’t be covered in any circumstances in which you are being “reckless.” Accidents happen, and you should always be cautious when you are traveling in a different country; however, if you are putting yourself or other people in danger, you likely won’t be covered.

Generally, extreme sports are also not covered. There can sometimes be plans that cost extra, which cover these types of activities. The “extreme” activities are things like paragliding, skydiving, bungee jumping and more activities beyond regular sports or hobbies.

Any accidents that occur under the influence of any substance are generally not covered. This is because this type of behavior is risky.

Pre-existing conditions are often not covered. If you have a regular medication that you need, your extra travel insurance usually won’t cover this. Your primary insurance may cover the medication instead. You’ll have to check if your primary insurance offers any international conditions.

If you leave your bags or personal items unattended, you’ll have a hard time claiming these situations with your travel insurance.

It is suggested to limit how much cash you carry on a trip, because you won’t be able to claim any lost cash. It’s really hard to track what you actually lost. Remember when traveler’s checks were a thing? Maybe they weren’t such a bad idea after all.

You won’t be able to get most travel insurances if you are over a certain age. If you are over 65, let’s say, check the conditions for plans you are considering to see if you will be covered.

Is travel insurance a one-time fee?

Depending on how long you are traveling, you can pay for your travel insurance all up front, or split it up into monthly payments.

World Nomads offers you a quote when you fill in your information for getting a quote on the website. You have to pay for the value of your trip insurance all “up front” in a lump sum.

Safety Wing offers travel insurance on a monthly basis. It’s designed for people who are traveling long-term, like digital nomads. The travel insurance service that you purchase will renew (and bill you) every month.

What is the purpose of travel insurance, and why is it important?

During your day-to-day life, your routine and patterns are somewhat predictable. You go to work (or work from home!), go to the grocery store, hang out in a park, host friends, and go out to a bar that you’ve been to 100 times.

When you travel, there are some things you pack, and one of the things on your list should be travel insurance. Well, you can’t technically pack travel insurance, but I think you know what I mean.

When traveling, part of the adventure is the unpredictability. You’ll be going to a new city or destination, trying new and exciting foods from unknown places and putting a lot of trust in new people you meet.

Travel insurance exists to protect your “what-if” situations, and can give you some peace of mind knowing that your safe decisions won’t end up costing you a lot of money.

A great example for travel insurance is when Becca woke up in Mexico City one day with a mysterious bruise on her hip. It ended up being nothing serious (luckily), but we saw a doctor referred by a friend, and he prescribed something to help with the inflammation swelling.

If the doctor recommended going to a hospital for more tests, we would have been able to claim those tests and get most (if not all) of that money claimed.

If something happens to you while you are traveling, you should get it treated. The travel insurance is there to help you with the costs. We’ve had friends have issues with some of their claims, and we’ve seen other friends have no issues. Their claims were accepted and paid right away.

We suggest doing your best to save all of your receipts. Also, take lots of documentation during your treatment. This includes all printed receipts, like Becca’s blood tests in Mexico, or other types of tests and receipts or prescriptions, wherever you go.

What should I know about filing a claim with travel insurance?

Like I said above, take a lot of documentation during your incident. Take photos of everything! If you wake up sick, take photos of how you get to the hospital or doctor’s office. If you take an Uber or taxi, take a photo of your car and your ride. Take a photo of the receipt or meter from the taxi.

You never know if you’ll need to provide extra photo proof of something, so take more photos than you think you’ll need. If the police is involved, get a police report.

Make sure when you get treatment, you ask for receipts and any additional explanation of services. If the doctor is able to provide notes, make sure to request that as well!

If your condition is serious enough, contact your primary insurance and see what their coverage is and if they can support you through your process. You might not be covered, but your travel insurance might require you to first to make a claim through your primary insurance.

Most travel insurance companies allow you to file a claim online. Whenever I have filed claims, the process is fairly long and comprehensive. The process for every individual insurance company is going to vary. Keep that in mind when evaluating different options for which company to go with.

File a claim as soon as possible. If you wait several weeks, it could cause delays, and you want to make sure you’ve done everything you can do get your claim paid out.

After your claim is filed, you’ll have to wait and the insurance company will evaluate your claim. You’ll be notified if your claim is accepted, and they will issue you a payment of the amount they are covering.

Does travel insurance cover theft?

In most cases, travel insurance will cover theft up to a certain value. You should file a local police report if you are mugged or robbed, and take photos of your surroundings. If your accommodation was broken into, take photos of the damage to the locks and the doors, for example.

Because you won’t be able to claim any theft that is your fault, you’ll need some proof that your theft was legitimate and not something caused by you leaving your bag in a public place.

And remember: travel insurance will not cover theft of cash.

Will travel insurance cover my stolen phone?

Maybe! World Nomads does have a policy on stolen electronics. It doesn’t appear that Safety Wing covers any lost electronics.

If you pay your cell phone bill with a credit card, check out your credit card benefits. It might be possible for your credit card company to help you out in that case.

Does travel insurance cover canceled flights?

Most of the time, travel insurance (like World Nomads and Safety Wing) will cover your medical issues while traveling. Canceled flights are usually not covered by these providers.

If you become sick or have an accident, and you need to cancel your flight, you can sometimes claim these circumstances.

Trip cancellations are tricky because they are based on a lot of different circumstances. In the best-case scenario, you may have refundable flights and hotels.

In the event of a cancellation, you will hopefully have enough time to exercise your refund.

Where can I learn more about travel insurance?

Safety Wing has a detailed and easy-to-read PDF detailing the company’s policy. Check it out.

World Nomads has lots of detailed articles covering most common cases that are relevant to you. See the World Nomads What’s Covered section, along with the “What to do if” section.

We suggest calling your primary insurance and asking what the policy on travel insurance is. It would be good to know what you already have, in terms of coverage.

Check with your travel credit cards. They can sometimes have some benefits for your belongings and rental cars.

Get several quotes and compare your options for travel insurance. Once you get quotes, compare some of the features that matter the most to you.

Also, fun fact: we were guests on the World Nomads podcast! Check out our World Nomads podcast episode here.